Attain Your Desires with the Assistance of Loan Service Professionals

Attain Your Desires with the Assistance of Loan Service Professionals

Blog Article

Simplify Your Financial Journey With Relied On and Reliable Finance Providers

In the world of individual money, navigating the myriad of car loan options can frequently really feel like a challenging job. Nonetheless, when furnished with the right tools and support, the journey towards safeguarding a financing can be structured and hassle-free. Relied on and efficient loan solutions play a pivotal duty in this process, supplying individuals a reliable course in the direction of their financial goals. By understanding the advantages of collaborating with reputable loan providers, exploring the different types of finance services offered, and focusing on crucial elements that establish the best suitable for your needs, the course to economic empowerment becomes clearer. Yet, truth essence hinges on how these services can be leveraged to not only protected funds however additionally to maximize your economic trajectory.

Advantages of Trusted Lenders

When looking for financial help, the benefits of selecting relied on loan providers are paramount for a safe and trusted borrowing experience. Trusted loan providers provide transparency in their terms, supplying borrowers with a clear understanding of their responsibilities. By collaborating with respectable lending institutions, borrowers can prevent hidden fees or predative practices that might cause economic mistakes.

Additionally, relied on lenders typically have actually developed connections with regulative bodies, making certain that they operate within legal limits and abide by sector criteria. This conformity not only safeguards the customer but additionally fosters a sense of count on and integrity in the borrowing procedure.

Additionally, reliable loan providers prioritize customer care, using assistance and advice throughout the loaning trip. Whether it's making clear financing terms or aiding with settlement alternatives, relied on lending institutions are devoted to aiding debtors make knowledgeable economic choices.

Kinds of Loan Services Available

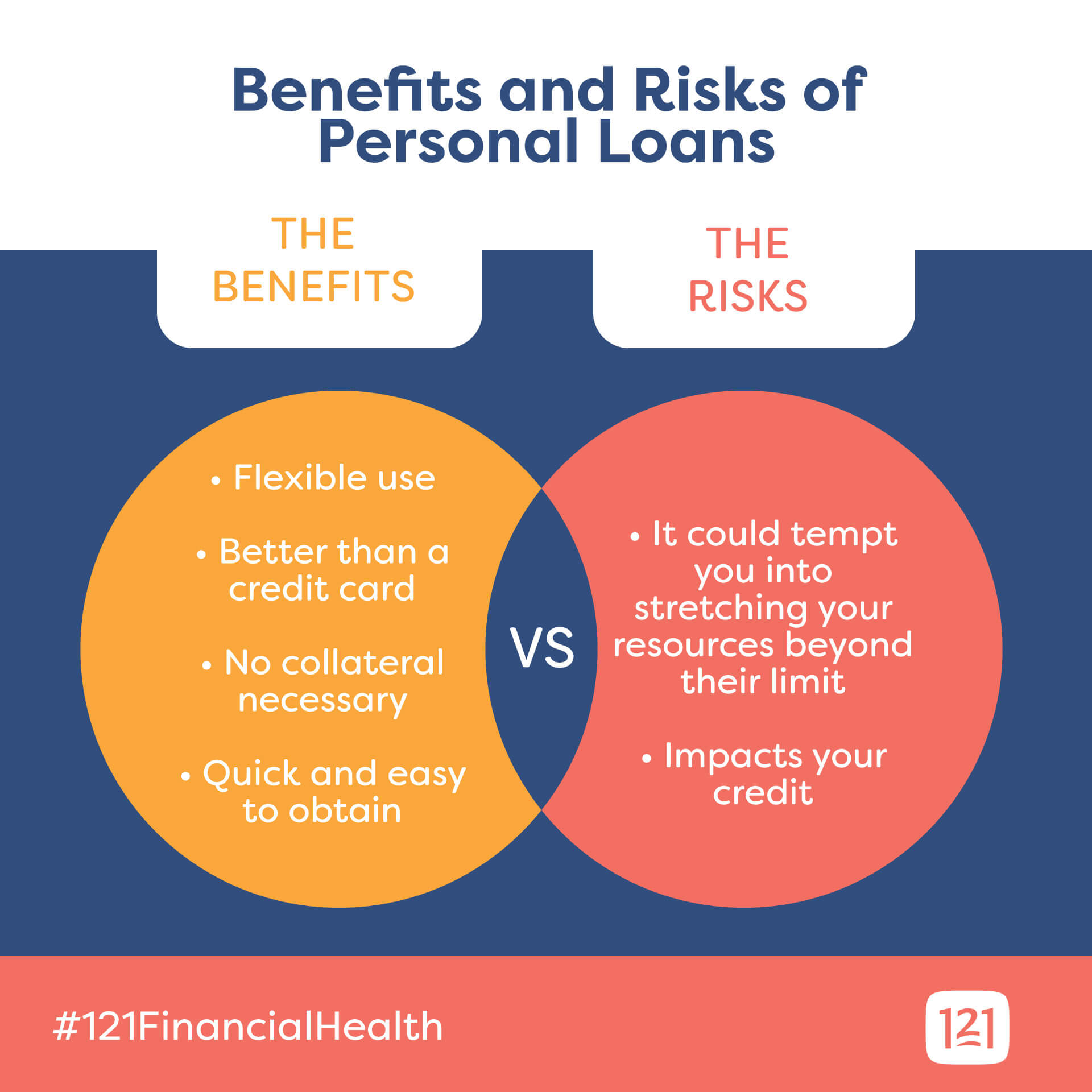

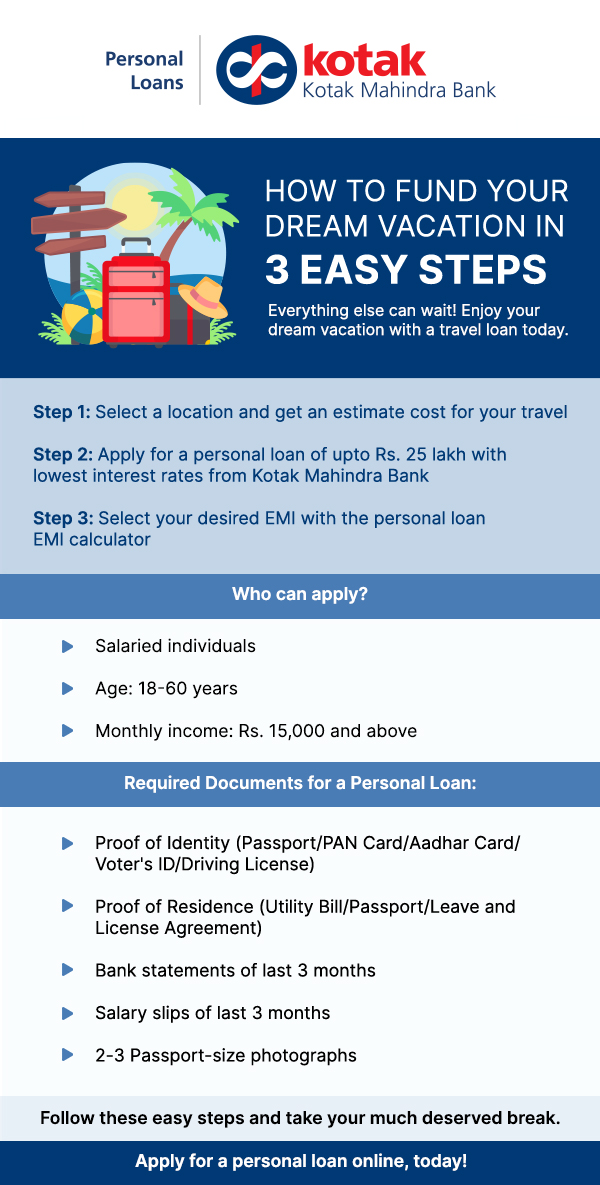

Different economic establishments and lending companies supply a diverse range of funding solutions to provide to the differing demands of borrowers. Some of the common types of finance solutions readily available include individual car loans, which are typically unprotected and can be utilized for numerous objectives such as financial debt consolidation, home renovations, or unexpected expenses. Understanding the different types of car loan services can assist borrowers make informed decisions based on their specific economic demands and objectives.

Aspects for Selecting the Right Finance

Having acquainted oneself with the diverse array of car loan solutions offered, consumers should diligently evaluate vital factors to choose the most suitable loan for their certain monetary demands and goals. Comprehending the payment routine, costs, and penalties connected with the finance is vital to stay clear of any surprises in the future - same day merchant cash advance.

Additionally, borrowers need to assess their existing monetary situation and future potential customers to determine the lending quantity they can conveniently manage. It is recommended his response to obtain only what is essential to reduce the economic concern. In addition, assessing the lending institution's reputation, customer care, and general transparency can add to a smoother loaning experience. By thoroughly taking into consideration these factors, debtors can pick the best finance that aligns with their monetary objectives and capacities.

Improving the Financing Application Refine

Efficiency in the funding application procedure is extremely important for making certain a smooth and expedited loaning experience. To simplify the car loan application process, it is vital to supply clear support to candidates on the called for paperwork and details - Financial Assistant. Making use of on the internet platforms for application entries can considerably reduce the time and initiative included in the procedure. Carrying out automated systems for verification of documents and credit score checks can accelerate the application testimonial process. Supplying pre-qualification options based upon standard info given by the applicant can assist in filtering system out ineligible candidates early on. Providing normal updates to applicants on the status of their application can boost openness and customer satisfaction. Streamlining the language used in application kinds and communication materials can assist in much better understanding for candidates. By integrating these structured processes, lending service providers can supply a much more efficient and easy to use experience to debtors, ultimately boosting overall consumer satisfaction and loyalty.

Tips for Effective Finance Payment

Prioritize your financing repayments to avoid defaulting on any fundings, as this can adversely affect your credit report rating and economic security. In situation of monetary difficulties, communicate with your lender to explore possible alternatives such as lending restructuring or deferment. By staying arranged, aggressive, and monetarily disciplined, you can effectively navigate the process of repaying your loans and attain better monetary flexibility.

Conclusion

In verdict, making use of relied on and reliable loan services can considerably simplify your monetary journey. By thoroughly choosing the best lender and type of lending, and improving the application process, you can ensure an effective loaning experience.

Report this page